James Amoo, Community Partner

May 8, 2025

Artificial Intelligence is changing operations across several industries, and the financial sector isn’t exempt. According to a recent KPMG survey, approximately 71% of organizations are now leveraging AI in their finance operations, with about 57% of industry leaders reporting that it delivered an ROI that exceeded their expectations. Leading organizations are now using AI to streamline processes like financial forecasting, portfolio optimization, and risk assessment. This shows the importance of AI in boosting productivity and achieving actionable insights faster.

The big question is: How do we use AI for financial analysis? That’s where AI finance tools come in. These tools help to integrate AI into financial workflows, and the success of any AI-driven finance strategy often depends on choosing the right tool. With many AI financial analysis tools available on the market today, finding the right tool can be challenging for both individuals and organizations

In this blog post, we’ll explore the best AI tools for finance, discussing their key features and how they help boost accuracy and efficiency. After reading this blog post, you’ll be well-equipped to choose the tool that best aligns with your needs.

Why should you use AI finance tools?

Let’s discuss some of the benefits of AI tools in finance:

- Automation: AI finance tools help to automate major workflows and finance operations, leading to faster insights. By using the right data automation software, users can streamline repetitive tasks such as data entry and invoice processing and focus on more strategic tasks.

- Financial forecasting: Compared to traditional methods, AI finance tools can handle huge amounts of data, analyze it, and make accurate predictions based on the data. This helps companies save time and make more informed decisions based on relevant projections.

- Increased productivity: By automating tasks that would otherwise require manual effort, AI finance tools reduce operational costs and boost team productivity. Also, some AI finance tools offer ready-made finance templates that allow users to perform complex tasks without starting from scratch.

- Self-service analytics: AI finance tools help bridge the gap between data fluency and data literacy, enabling both technical users and citizen developers to analyze financial data efficiently. These tools allow users to self-serve analytics, making data-driven insights more accessible across the organization.

Quadratic

Quadratic is an AI-powered spreadsheet designed to perform both simple and complex finance analysis, accelerating the path to gaining actionable insights from your data. It enables users to view, analyze, and visualize financial data all from a single location. Quadratic’s built-in AI feature allows users to ask questions based on their data and get results quickly. Unlike other AI tools for data analysis that give a black-box answer to AI queries, it provides a method that users can check, reuse, and evolve.

Being a spreadsheet, Quadratic comes with traditional formulas for analysis, and it also provides support for modern programming languages that allow users to write and execute code directly in their spreadsheet. Quadratic’s intuitive interface makes it easy to use for users of varying skill sets. Let’s discuss the key features of Quadratic:

Features of Quadratic

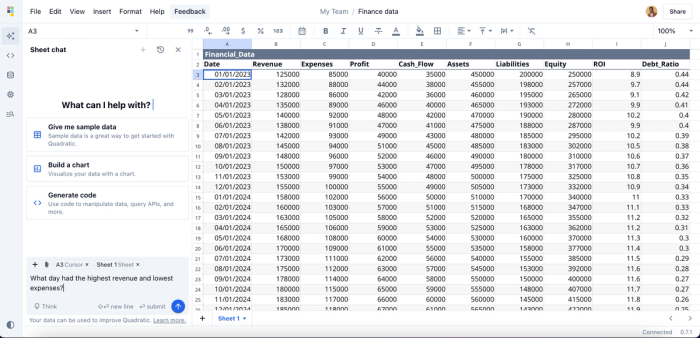

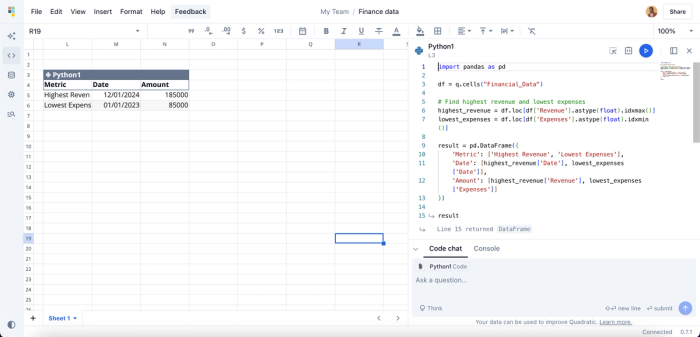

- AI-powered analysis: This feature allows you to perform basic and advanced analysis on your financial data. Simply ask questions using natural language queries and Quadratic AI generates code to perform analysis on your data. Here’s an example of using Quadratic AI to generate insights from financial data:

Here, I’ve imported a large set of financial data into the Quadratic interface. Analyzing data of this size through manual methods would be time-consuming, but Quadratic makes the process easier.

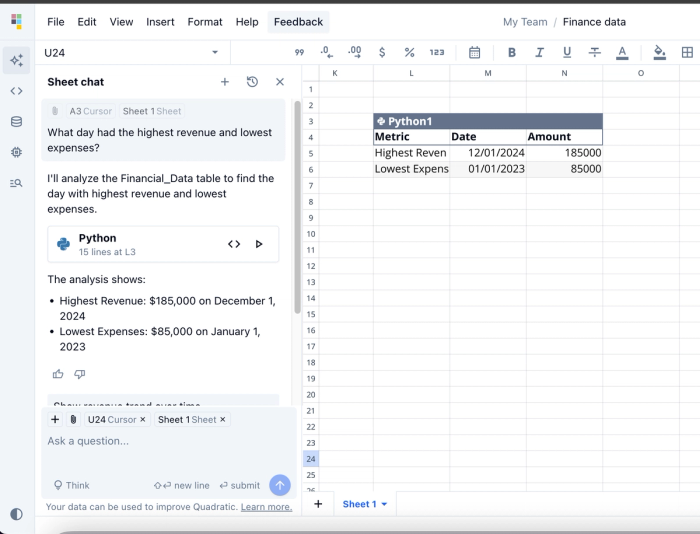

You can perform complex analysis on your data without writing code or formulas. For example, to find the day with the highest revenue and the day with the lowest expenses, all I had to do was ask:

In the image above, Quadratic provides answers to our queries and generates a table for a better understanding of the analysis. This approach to using AI to generate formulas and code saves time and effort that would’ve been spent on manual analysis.

- Multiple data sources: Quadratic connects directly with multiple databases, APIs and raw data, allowing you to pull financial data from several sources.

- Support for modern programming languages: Quadratic provides native support for programming languages like Python, SQL, and JavaScript. It offers a built-in code editor where users can write and execute code. This flexibility allows technical users to perform advanced analyses on their financial data.

Here’s the code equivalent of the analysis we performed using Quadratic AI:

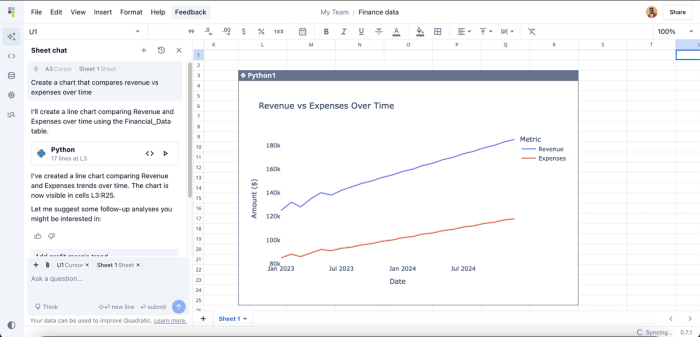

- Visualizations: Data visualization makes it easy for users to spot trends, patterns, and uncover important insights. Quadratic offers a variety of charts to visualize your financial data effortlessly; all you have to do is describe how you want to present your data.

Here’s an example:

I asked Quadratic AI to create a chart that compares the trend of revenue and expenses over time, and it instantly generated a line chart that shows the progression. While this looks like magic, what happens under the hood is that Quadratic generates Python code to visualize our data using built-in Plotly libraries. The visualizations generated are highly customizable and can be further refined to fit your desired output through additional text prompts.

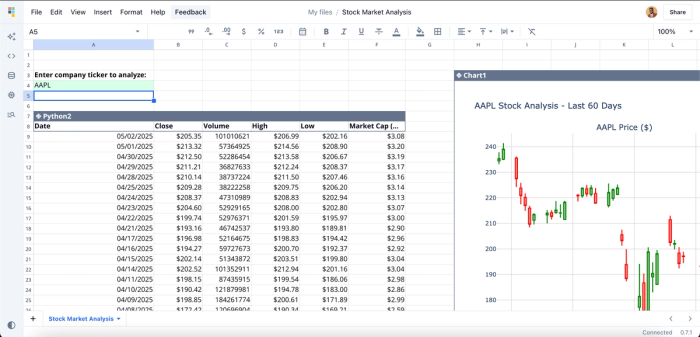

- Templates: Quadratic provides a wide array of customizable spreadsheet templates on financial data for both personal and professional use. Templates in Quadratic are built to solve a variety of financial tasks, including stock market analysis, time series analysis, and asset research. The major advantage of these templates is that they allow you to perform advanced analysis without starting from scratch.

Let’s explore the stock market analysis template from Quadratic:

The stock market analysis template requires the particular stock ticker you want to analyze. In the example above, I entered the AAPL ticker (Apple Inc.) in the cell, and it instantly generated metrics like the closing price, trading volumes, and price ranges. It also created visualizations to better understand the stock trend and gain more insights into the company’s valuation.

This template saves a ton of time that would’ve been invested in setting up an environment for this purpose.

- Collaboration: Quadratic offers a collaborative environment where you can share insights from your financial data with other team members. Users can see edits from other team members in real-time, providing a seamless collaboration experience.

- Performance: Built on a modern web app architecture, Quadratic offers a smooth and highly responsive experience even when working with large amounts of financial data.

- Pricing: Quadratic leads the list of free AI tools for finance as it comes at no cost for individuals, with limits on AI usage. For teams of three or more, a plan at 18$/month is available, offering 10-20x higher AI limits, unlimited sharing, and more.

Vena Insights

Vena insights is an AI-powered intelligence reporting platform designed to streamline financial planning and analysis (FP&A). It uses predictive analysis and advanced machine learning models to identify important trends and improve forecast accuracy. Like Quadratic, Vena Insights connects to many data sources, allowing users to pull data from different sources into the built-in dashboard for analysis. Its intuitive interface makes it easy to use, catering to users of all skill sets. Vena Insights is one of the best AI tools for finance and accounting.

Key features of Vena Insights

- Dashboards: Vena Insights allows users to pull data from different sources and view it in a dashboard. Users can customize their dashboard to fit their needs.

- Embedded Power BI: Built on Microsoft Power BI, Vena Insights offers intelligent reporting and analysis, allowing users to quickly identify risks and spot crucial opportunities.

- Real-time data integration: Data in Vena Insights can be accessed in real-time, so users do not need to juggle between multiple tools to view their data.

- Predictive analytics: Vena Insights’ predictive analytics helps to improve forecast accuracy, spot unusual trends, and make informed decisions based on the data.

Zest AI

Zest AI is a platform that uses artificial intelligence to automate and optimize lending decisions by financial institutions. It streamlines credit risk assessments, loan approvals, and fraud detection. By providing a detailed evaluation of borrowers, Zest AI provides lenders with more information, allowing them to make faster, inclusive, and efficient lending decisions.

Features of Zest AI

- Broad data inputs: It analyzes a wide range of data points to assess borrower risk, which provides more depth in analyzing risk than traditional credit scores.

- Fraud detection: Zest AI's robust fraud detection system boosts lenders' confidence as it offers top-tier protection against application fraud.

- Lending intelligence: Zest AI enhances lending strategy by providing consistent AI-powered insights with trusted accuracy. It also provides a deeper understanding of key loan metrics, enabling lenders to make more informed decisions.

- Fair access: The models in Zest AI are well optimized for fairness and accuracy, reducing bias and ensuring all applicants get a fair shot at approval.

Stampli

Stampli is an AI-powered Accounts Payable (AP) automation system that enhances payment processes in finance teams, reducing the risk of manual errors and disruptions. It streamlines finance tasks like invoice processing, vendor management, and approval workflows. Stampli’s AI solution extends across procurements, AP, payments, and credit card transactions, increasing efficiency in AP departments.

Features of Stampli

- Invoice processing: Stampli automates invoice processing with its intelligent invoice capture capability, processing payments with minimal human interaction. Users can also collaborate directly on invoices, ensuring transparency across teams and faster processing.

- AI-powered insights: Stampli’s AI copilot learns users’ unique patterns in invoice management. It makes suggestions on processes like coding, routing, and status tracking.

- Integrations: It provides seamless integration to top ERPs like NetSuite, QuickBooks, and Sage Intacct.

- Vendor management: Stampli offers a centralized portal to manage vendors’ interactions. It enhances processes like onboarding, communication, and document compliance. This portal helps to reduce the volume of invoice inquiries as vendors can easily view the status of their invoices.

DataRobot

DataRobot is an AI platform designed to enhance finance operations such as forecasting, credit risk assessment, and portfolio management. It helps to automate the process of building and deploying machine learning models to be used across various sectors. DataRobot provides AI insights that enable finance teams to effectively manage risks and make informed decisions.

Features of DataRobot

- Financial forecasting: DataRobot AI insights empower users to make more accurate financial forecasts, including cash flow predictions, expense modeling, and scenario planning.

- Portfolio management: It enhances traditional portfolio management as it provides additional insights into asset allocation and investment prediction.

- Risk assessment: DataRobot helps to examine users’ portfolios and provides insights into risk factors like market downturns and interest rate changes.

- Integrations: DataRobot integrates with data platforms, business applications, and APIs.

Conclusion

As artificial intelligence rapidly transforms operations in the finance sector, individuals and organizations must act strategically to stay ahead of this transition. This means leveraging AI to enhance analysis and boost your overall productivity.

AI tools for finance are built to enhance various finance operations, including financial analysis, data visualization, risk assessment, portfolio optimization, and forecasting. Having explored the top AI tools for financial analysis, it’s important to note that choosing the right AI tool ultimately depends on your needs and the nature of your daily finance operations.

Quadratic remains a top choice as it offers AI-powered financial analysis, seamless data visualizations, support for modern programming languages, and a collaborative environment. It also comes with a variety of finance templates that help you achieve complex tasks with ease. Try Quadratic for free today.