T Financial Analysis FAQs

How can I analyze T financial data with AI?

You can use Quadratic to analyze AT&T (T) financial data by scraping online sources, connecting live API data, and asking AI natural-language questions about revenue, earnings, growth, or valuation. Quadratic instantly visualizes and explains T's financial trends without leaving the spreadsheet.

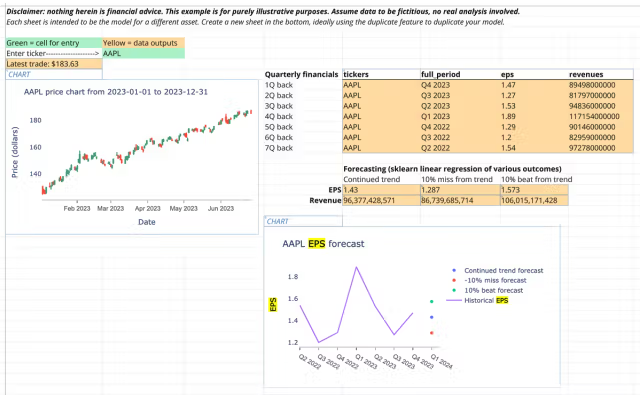

Can I forecast AT&T's future performance?

Yes. Quadratic helps you forecast T's future revenue, margins, or stock performance using Python-powered modeling. You can pull live financial data, apply predictive formulas, and generate visual projections of AT&T's potential growth directly inside your Quadratic workbook by just asking the AI.

What live data can I pull for T?

Quadratic's AI Research feature lets you pull live data from the web — including T's financial statements, analyst estimates, and market trends — and combine it with your own datasets, CSVs, or APIs for deeper analysis and visualization.

Can I compare T with competitors?

Absolutely. Use Quadratic to compare T against competitors in the same industry. The AI can pull comparable company data, calculate ratios like P/E or P/S, and visualize how AT&T's performance stacks up against the market.

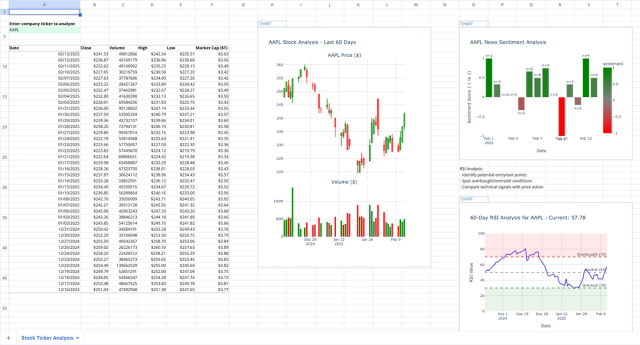

How do I visualize T financial trends?

You can create charts and dashboards directly in Quadratic. The AI can automatically turn T data into graphs showing revenue growth, profit margins, valuation multiples, and more, all within the same spreadsheet.

Where does Quadratic get T data from?

Quadratic can connect to multiple sources — from CSV and Excel uploads to SQL databases, APIs, and web data — allowing you to gather T's latest financial information from trusted sources in real time.

Can I collaborate on my T analysis?

Yes, Quadratic supports real-time collaboration. You can invite teammates to analyze AT&T's financial data together, run AI-powered research, and share dashboards, all in a secure, browser-based spreadsheet.

How can I use Quadratic for ongoing T research?

Set up a live Quadratic sheet to track T over time. Use AI to refresh data from the web or connect to a public API, update forecasts automatically, and identify new financial trends as they emerge, turning your spreadsheet into a living research tool.