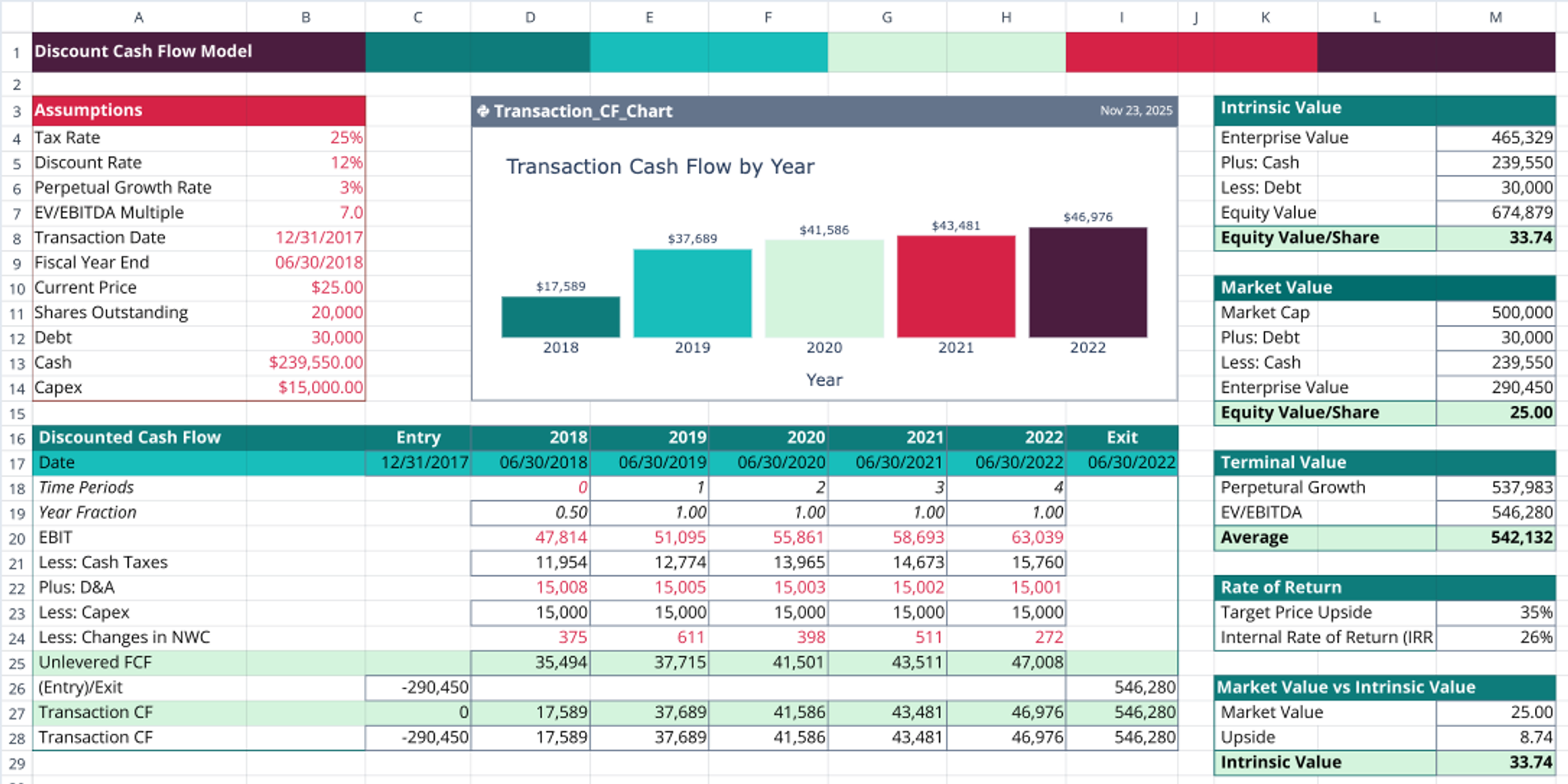

Our Discounted Cash Flow (DCF) model template provides a comprehensive framework for valuing companies using the discounted cash flow methodology. This discounted cash flow template helps financial analysts, investors, and business professionals determine a company's intrinsic value by projecting future free cash flows and discounting them to present value.

Whether you're evaluating acquisition targets, assessing investment opportunities, or conducting equity research, this discounted cash flow model template streamlines the valuation process with automated calculations and visual analytics.

How to use this template

This basic DCF model template is designed for intuitive use, even if you're new to financial modeling:

- Input core assumptions: Start by entering key parameters including tax rate, discount rate (WACC), perpetual growth rate, and your EV/EBITDA multiple preference. Update the transaction date and fiscal year end to align with your analysis period.

- Enter company financials: Input current market data including share price, shares outstanding, debt levels, and cash on hand. These form the foundation of your valuation.

- Project financial metrics: While the template provides a framework, you'll input or link revenue projections, EBITDA, taxes, depreciation & amortization (D&A), capital expenditures (Capex), and changes in net working capital (NWC).

- Review automated calculations: The template automatically calculates unlevered free cash flow, applies discount rates, and generates both enterprise value and equity value per share.

- Analyze results: Compare the calculated intrinsic value against current market prices to identify potential over- or undervaluation. Interactive charts visualize transaction cash flows and help communicate findings to stakeholders.

Best practice tip: Regularly stress-test your assumptions by adjusting discount rates and growth projections to understand valuation sensitivity.

Who benefits from this template

This DCF model Excel template alternative is ideal for:

- Investment professionals: Private equity analysts, venture capitalists, and investment bankers conducting due diligence and valuation exercises

- Corporate finance teams: CFOs and finance managers evaluating strategic acquisitions or divestitures

- Equity research analysts: Professionals publishing buy/sell recommendations based on fundamental analysis

- MBA students & academics: Individuals learning financial modeling and corporate valuation techniques

- Individual investors: Sophisticated retail investors performing fundamental analysis on potential stock purchases

Real-world use cases: A private equity firm uses this template to model acquisition scenarios across multiple industries, while a corporate development team evaluates whether an acquisition target's asking price aligns with its intrinsic value based on projected synergies.

Why choose this template

Unlike static DCF model Excel templates, this one leverages Quadratic's modern spreadsheet capabilities, combining familiar financial modeling with enhanced visualization tools. The integrated charts provide immediate visual feedback, making it easier to present findings to investment committees or clients.

Get started today

Ready to enhance your valuation workflow? Duplicate this discounted cash flow model template and start making data-driven investment decisions with confidence. Whether you're analyzing a single opportunity or building a portfolio of valuations, this template provides the analytical foundation you need.

Related templates

Operating Cash Flow Calculator

Analyze and visualize operating cash flows from financial statement inputs.

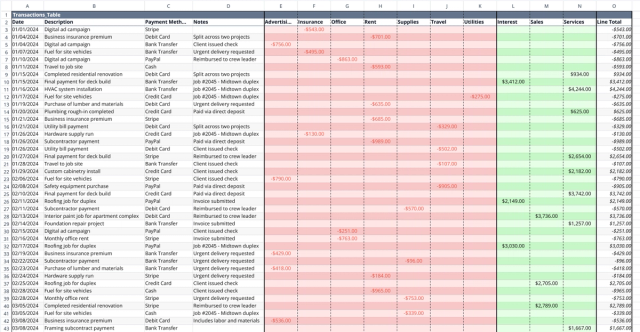

Small Business Bookkeeping Template

Track income and expenses, visualize cash flow trends, and gain financial insights.

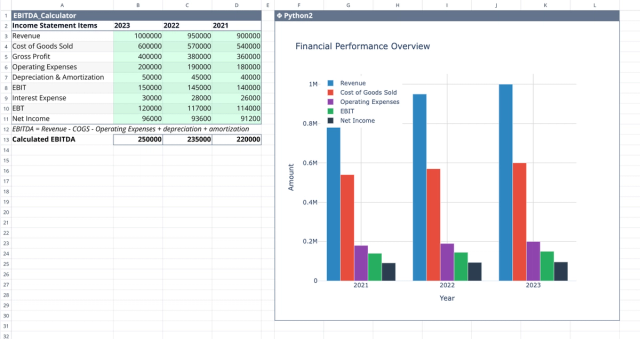

EBITDA Calculator

Simplify your financial performance analysis with accurate operational insights.