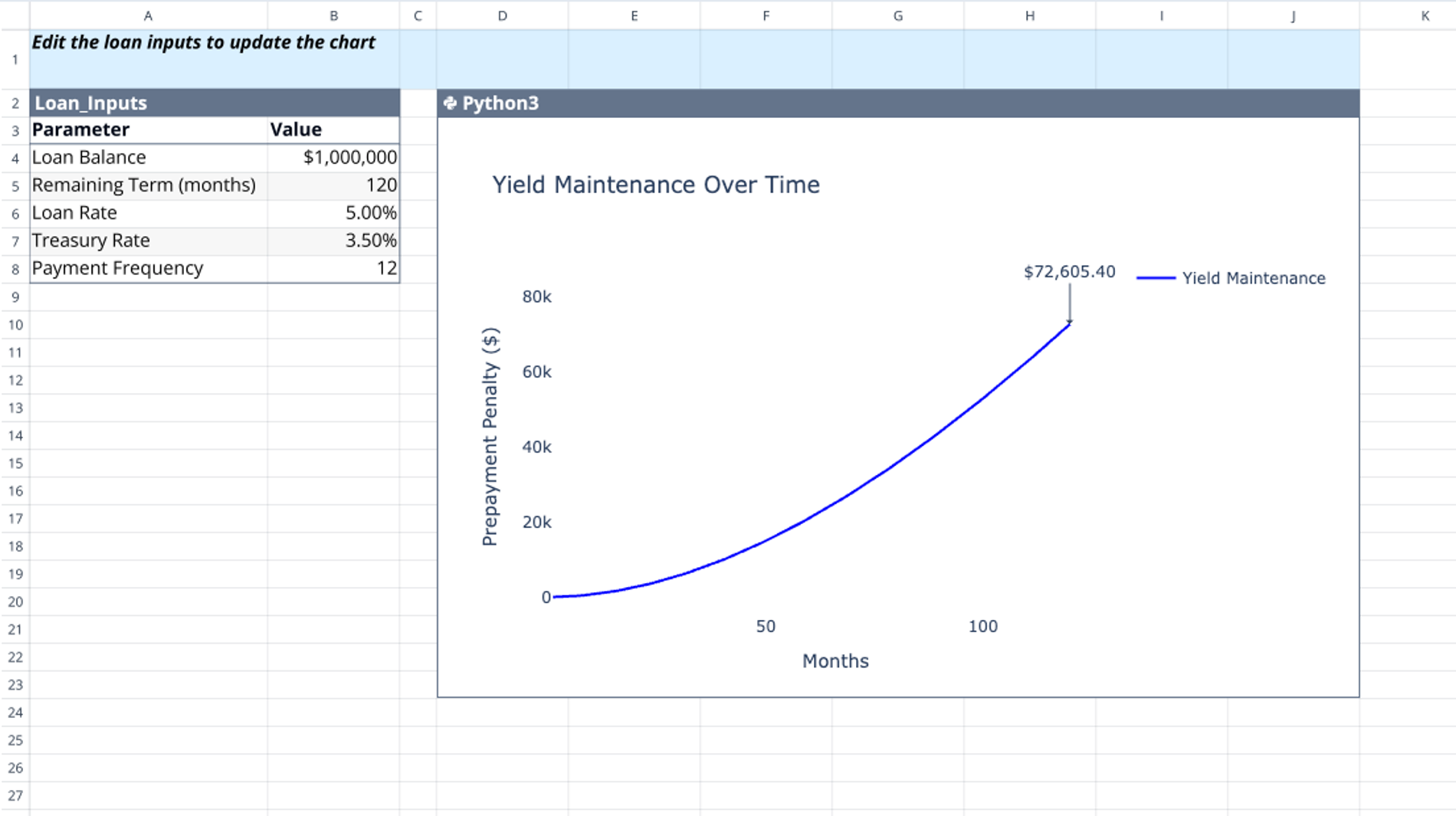

Calculate and visualize yield maintenance prepayment penalties with precision using this interactive template. Built for commercial real estate professionals, lenders, and analysts, this yield maintenance calculator provides instant insights into prepayment costs across your loan's timeline.

Key features:

- Dynamic yield maintenance calculation based on current treasury rates

- Interactive visualization showing penalty changes over time

- Simple input interface for loan balance, terms, and rates

- Real-time updates as you modify parameters

- Professional-grade charts for presentations and analysis

How it works:

- Enter your loan details in the clearly labeled input table

- View the automatically generated yield maintenance curve

- Adjust variables to explore different scenarios

- Use the visual graph to identify optimal prepayment timing

Perfect for:

- Commercial real estate investors evaluating prepayment options

- Loan officers explaining prepayment penalties to clients

- Financial analysts preparing loan cost assessments

- Asset managers optimizing debt strategies

- Real estate professionals comparing loan terms

This template streamlines complex yield maintenance calculations that traditionally require multiple tools or manual computations. Unlike basic Chatham yield maintenance calculators, it provides both numerical results and visual insights, helping you make informed decisions about loan prepayment timing and costs.

The intuitive design makes it accessible for both seasoned financial professionals and those new to yield maintenance concepts. Built on Quadratic's powerful platform, it combines spreadsheet familiarity with advanced visualization capabilities.

Whether you're analyzing a single loan or comparing multiple scenarios, this template helps you understand potential prepayment penalties at a glance. The dynamic chart updates instantly as you modify inputs, making it easy to communicate findings with stakeholders.

Ready to simplify your yield maintenance calculations? Try this template now and transform complex prepayment analysis into clear, actionable insights.

Related templates

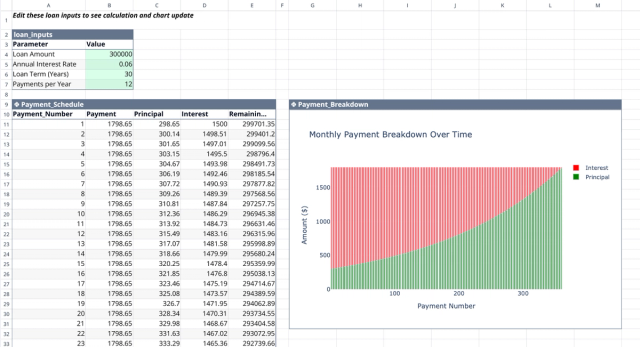

Loan Amortization Schedule Calculator

Visualize loan payments, track interest costs, and understand loan trajectory over time.

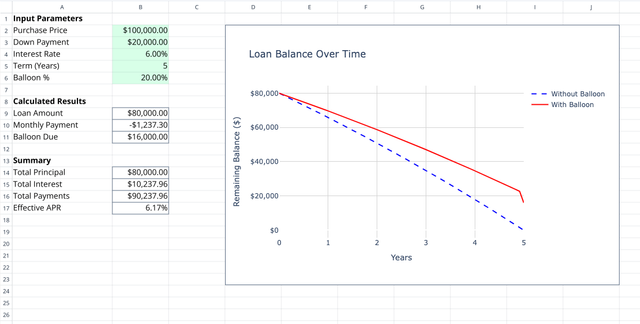

Land Financing Calculator

Interactive land loan payment calculator with balloon payment option.

Real Estate Pro Forma Template

Quickly evaluate potential real estate investments. Track income and expenses, Determine IRR and analyze equity building of real estate.