In the current regulatory landscape, specifically under the weight of IRS Code 280E, revenue does not equal profit. For cannabis operators, top-line growth is often celebrated, but operational efficiency is the only lever that truly protects the bottom line. When businesses cannot deduct standard operating expenses, the accuracy of Cost of Goods Sold (COGS) becomes the difference between a thriving business and one that is slowly bleeding cash.

Defining successful cannabis retail operations requires looking beyond the front-of-house activities like budtending and POS transactions. True profitability is determined by the complex supply chain that precedes the sale. For vertically integrated operators or those managing tight processing relationships, the challenge lies in tracking unit economics when a single batch of biomass splits into multiple product lines—such as flower, pre-rolls, and concentrates.

The difficulty of managing these variables often leads to reliance on static bookkeeping methods that look backward rather than forward. However, sustainable retail success requires moving toward dynamic financial modeling and leveraging financial data analytics. Operators need the ability to account for processing yields, packaging costs, and raw material fluctuations in real-time to ensure that the price on the shelf actually covers the cost of getting it there.

The hidden cost of static planning in cannabis

The complexity of cannabis production makes standard, "flat" spreadsheets a liability. In a traditional retail environment, you might buy a widget for a dollar and sell it for two. In cannabis, you grow or purchase raw biomass, which then undergoes extraction, distillation, and formulation. A change in the cost of raw flower or a fluctuation in extraction yields affects the margin of five different downstream products simultaneously.

The "static gap" is where many operators lose money. Most businesses rely on static spreadsheets where updating a single variable—like a supplier increasing the price of nutrients or packaging—requires manual updates across dozens of cells and tabs. This manual maintenance is slow and prone to human error.

The risk here is significant. If your COGS calculation is off by even a few cents per gram due to an outdated formula, your entire pricing strategy could be compromised. You might be running a promotion that you believe is breaking even, while in reality, it is eroding your gross margin. In an industry with price compression, accurate, dynamic data is the only defense against invisible losses.

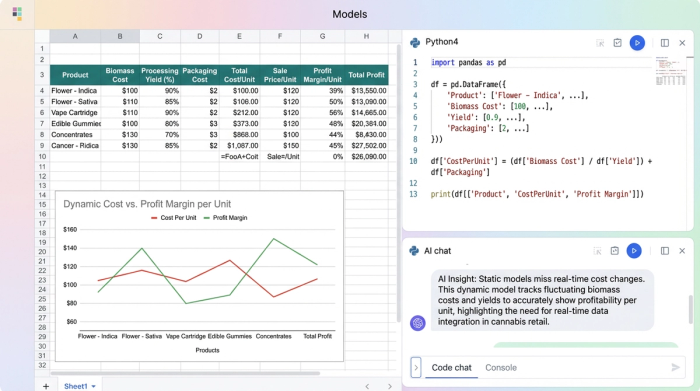

Case study: modeling processing economics in Quadratic

To bridge the gap between processing costs and retail pricing, we can look at a real-world workflow inside Quadratic. A cannabis operator needed to move beyond static Excel templates to analyze profitability across different production scenarios. Their goal was to understand exactly how changes in the supply chain impacted the final margin of their finished goods.

The workflow began by mapping out the "recipe," or Bill of Materials (BOM), for their products. Using Quadratic’s infinite canvas, the user visualized the flow of materials: raw biomass entering the facility, passing through extraction to become crude oil, being refined into distillate, and finally being filled into vape cartridges.

Once the flow was established, the user layered in the variables. This included not just the cost of the biomass, but also the labor hours required for extraction, the cost of solvents, and the specific unit costs for hardware and packaging. In a standard spreadsheet, this data often turns into "spreadsheet spaghetti," where tracing the logic of a calculation becomes impossible. In Quadratic, the user was able to structure this data logically, using Python to handle the complex yield calculations that determine how much oil is produced from a specific weight of flower.

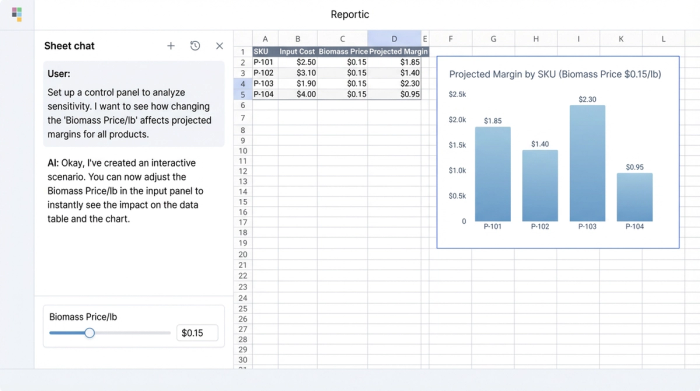

The critical advantage of this workflow was dynamic toggling. The user created a control panel where they could adjust a single Input Cost—such as the price of biomass per pound. Because the model was dynamic, this single change instantly updated the Projected Margin for every finished SKU linked to that material, which is a form of sensitivity analysis.

From production cost to shelf price

Connecting back-end analysis to front-end strategy is how data turns into profit. Once the operator established a dynamic view of their COGS, they used the model to dictate their retail pricing strategy.

This setup allowed for precise break-even analysis. Instead of guessing a retail price based on competitors, the user could calculate the exact price point needed to maintain a specific margin percentage after taxes. This removed the guesswork from pricing discussions and ensured that every discount or wholesale deal was backed by hard numbers.

The model also empowered the team to conduct scenario planning, leveraging techniques like Monte Carlo simulation. They could ask "What If?" questions directly in the spreadsheet. for example: "If we lower the price of edibles by 10% for a holiday promo, how much additional volume do we need to move to maintain the same gross profit dollars?" The ability to calculate marginal revenue and simulate these outcomes allows retail managers to approve or reject promotions based on financial reality rather than intuition.

Ultimately, this data dictates which products get shelf space. If the Quadratic model reveals that pre-rolls have a shrinking margin due to rising labor costs, while vape cartridges are benefiting from cheaper hardware, the retail operation can pivot. They can allocate more shelf space and marketing spend to vapes, optimizing the product mix for maximum profitability after a careful cost benefit analysis.

The best tech for cannabis retail operations

When operators search for the best tech for cannabis retail operations, the conversation often starts and ends with the Point of Sale (POS) system. While the POS is critical for transactions and compliance, it is a system of record, not a system of intelligence. The "best" tech stack includes a decision intelligence layer that sits behind the POS.

Tools like Metrc, Dutchie, or Blaze are essential for tracking inventory and staying compliant with state regulations. However, Quadratic serves a different, equally vital purpose: strategy and forecasting. While your POS tells you what you sold yesterday, Quadratic helps you decide what you should sell tomorrow and at what price.

In a volatile market, technology must enable agility. Operators need tools that allow them to react to market price compression in real-time. By integrating a flexible, code-enabled spreadsheet into the tech stack, businesses can analyze data from their POS and ERP systems to spot trends, refine recipes, and protect margins against volatility.

Conclusion: optimizing for margin, not just revenue

Successful cannabis retail operations rely on granular data visibility. In an industry where 280E limits the ability to deduct expenses, maximizing the accuracy of COGS is not just an accounting exercise—it is a survival strategy.

Moving from static spreadsheets to dynamic modeling allows operators to protect their margins. It transforms financial planning from a quarterly headache into a daily strategic advantage. By understanding the exact cost of every gram that crosses the counter, operators can price with confidence and navigate market fluctuations without sacrificing profitability.

Stop guessing at your margins. Start modeling them dynamically with Quadratic to see how changes in production impact your bottom line instantly.

Use Quadratic to do cannabis retail operations

- Dynamically calculate accurate COGS for complex cannabis products, instantly accounting for biomass splits, processing yields, and packaging costs.

- Build flexible financial models that automatically update projected margins across all finished SKUs when a single input cost—like biomass price or extraction labor—changes.

- Conduct precise break-even analysis and scenario planning to inform retail pricing strategies, evaluate promotions, and understand the real impact on gross profit dollars.

- Visualize complex material flows and layer in variables like labor and solvents without "spreadsheet spaghetti," using Python for robust yield calculations.

- Move beyond static spreadsheets to a dynamic decision intelligence layer that empowers strategic pricing, optimizes product mix, and protects margins against market volatility.

Stop guessing at your margins and start modeling them dynamically. Try Quadratic.