Most debt snowball trackers tell you when you will be debt-free, but they fail to tell you if you will have enough cash in your checking account to make the payment on the 15th of the month.

Standard tools—whether they are rigid mobile apps or static spreadsheet templates—often treat debt in a vacuum, a common limitation of static financial planning tools. They calculate payoff dates based on average monthly surpluses, assuming your financial life is a flat line. A standard snowball debt tracker might suggest an aggressive extra payment, but it won't warn you that doing so will leave you with $12 in your checking account three days before payday. You have bi-weekly paychecks, credit card statement cycles, rent clearing on specific days, and unexpected expenses. A standard snowball debt tracker might suggest an aggressive extra payment, but it won't warn you that doing so will leave you with $12 in your checking account three days before payday.

To truly optimize debt payoff without risking overdrafts or liquidity stress, you need more than a tracker; you need a cash flow modeler. By using Quadratic, you can build a dynamic system that combines the psychological momentum of the snowball method with the precision of professional financial modeling. This approach ensures every dollar sent to debt is safe, efficient, and timed correctly.

Why standard debt snowball trackers fall short

The most common method for debt reduction is the Dave Ramsey debt snowball tracker approach, where you list debts from smallest balance to largest, regardless of interest rate. This creates psychological momentum as you knock out small debts quickly. While this method is excellent for motivation, the tools built around it often lack mathematical nuance regarding cash flow timing.

The limits of analog and basic digital tools

Many people begin their journey with a debt snowball tracker printable or a bullet journal debt snowball tracker. These are excellent for visualization—coloring in a thermometer on the fridge provides a tangible sense of progress. However, paper cannot calculate daily interest accrual, nor can it adjust your entire timeline instantly if you miss a payment or have a medical emergency.

Digital alternatives often fare only slightly better. A standard debt snowball tracker Excel or debt snowball tracker Google Sheets template typically operates on monthly totals. You input your income and expenses, and the sheet tells you that you have a $400 surplus. The flaw in this logic is that it assumes that $400 is available at the exact moment your credit card bill is due. It rarely handles "lumpy" expenses (like semi-annual insurance premiums) or the delay between credit card spending and the payment due date.

The missing link: liquidity

To truly optimize your financial path, you must track liquidity alongside amortization. Liquidity is the reality of your checking account balance on any given day. A sophisticated model does not just ask "Can I afford this debt payment this month?" It asks, "Will making this payment on Tuesday cause me to dip below my safety threshold on Thursday?"

Building a "cash-flow aware" debt model

In Quadratic, you can build a model that bridges the gap between income timing and debt demands. This moves beyond simple tracking into the realm of financial data analytics and cash flow engineering.

Setting the foundation

The first step in this workflow involves setting up income streams and variable expenses with precise timing. Instead of entering "Monthly Income: $5,000," you model the specific dates of bi-weekly paychecks. This granularity allows the model to project your checking account balance for every day of the month.

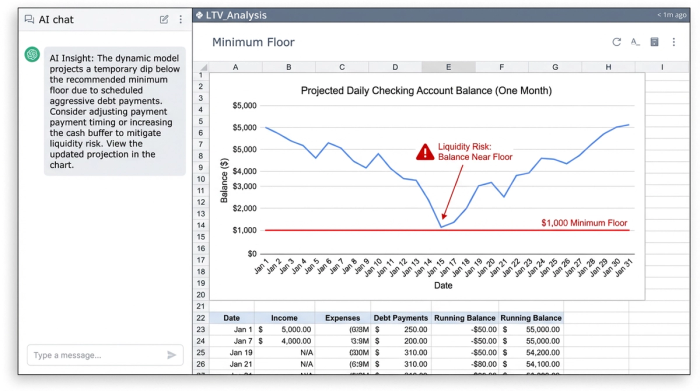

The "minimum floor" constraint

A critical feature of this advanced workflow is the "Minimum Floor." This is a user-defined constraint—for example, ensuring the checking account never drops below $1,000. This acts as a buffer against timing mismatches.

If a standard debt snowball tracker app suggests you pay an extra $500 toward a Visa card, it does so based on your total monthly surplus. However, if your rent clears the day before your paycheck, that extra payment might cause a temporary deficit. By modeling daily or weekly liquidity in Quadratic, the system can flag any payment that violates your minimum floor constraint, ensuring you only accelerate debt payments when it is actually safe to do so.

Dynamic credit card modeling

Sophisticated debt modeling also requires handling the "float." If you use a credit card for daily expenses (groceries, gas) and pay it off in full, there is a lag between the transaction and the cash leaving your checking account.

Standard templates treat credit cards as static loans. In Quadratic, you can model "credit-card-eligible outgoings" that are accrued throughout the month but settled on the statement cycle date. This accurately reflects how cash moves, preventing the model from artificially deflating your checking balance before the bill is actually due.

Automating the math: amortization & promos

While basic debt snowball tracker free templates rely on simple subtraction, a robust model requires logic that handles interest rates, minimum payments, and promotional periods automatically.

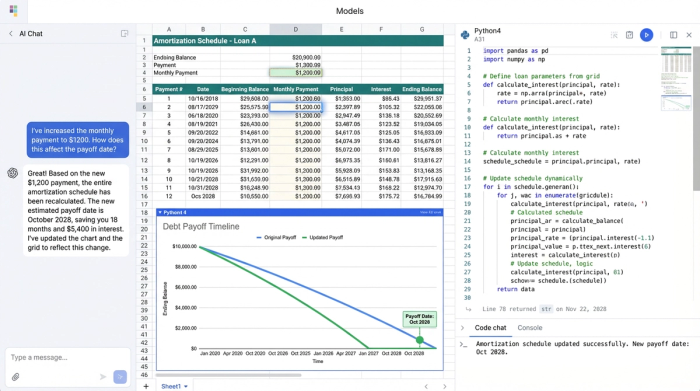

Handling complexity with Python and formulas

Quadratic allows you to use Python and advanced formulas directly in the grid. This capability is essential for calculating amortization schedules that adjust in real-time. When you make an extra payment, the model instantly recalculates the interest saved and the new payoff date across all subsequent debts. This eliminates the manual error prone to occurring in standard spreadsheets when formulas break or references shift.

Promotional expiry warnings

A unique advantage of building your own model is the ability to track promotional APRs. Many people juggling debt utilize 0% balance transfer offers. A standard tracker might treat a $5,000 balance at 0% as a low priority.

However, if that promotion expires in three months and the rate jumps to 24%, the priority changes. You can program Quadratic to flag these expiration dates. The model can calculate the "Remaining Balance at Expiry," allowing you to see exactly how much you need to pay to clear that specific debt before the interest spikes. This blends the Snowball method (smallest balance first) with necessary financial triage (highest risk first).

Total cost analysis

Beyond just monthly payments, the model outputs the total cost of debt—aggregating all interest and fees over the life of the loans. This provides a sober view of the true cost of borrowing and serves as a powerful metric for measuring the success of your aggressive payoff strategy.

Scenario analysis: balance transfers vs. consolidation

Quadratic’s ability to handle data and logic allows you to run financial stress tests and "What-If" scenarios, aligning with scenario planning best practices, to determine the best path forward.

The "what-if" workflow

You can set up different scenarios to test potential strategies, a key component of robust FP&A modeling:

- Scenario A: Stick to the standard Snowball method.

- Scenario B: Execute a balance transfer with a 3% fee and a 12-month 0% APR period.

- Scenario C: Take out a fixed-rate consolidation loan.

The Quadratic advantage

In a standard debt snowball tracker Excel file, comparing these scenarios usually requires saving multiple versions of the file or creating messy, duplicate tabs. In Quadratic, you can toggle these variables to see the immediate impact on two critical metrics: your Debt Free Date and your Minimum Cash Floor.

You might find that Scenario B saves you $1,000 in interest but requires a monthly payment that violates your $1,000 minimum cash floor during months with three paychecks. This level of analysis—balancing long-term savings against short-term liquidity risk—is a "Wall Street" level workflow applied to personal finance.

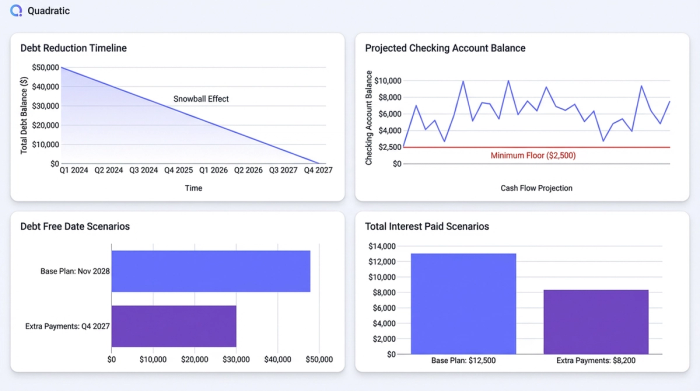

Visualizing the payoff

The output of this logic is a clean dashboard. Rather than a wall of numbers, you can generate graphs that visualize the "Snowball" effect (your total debt decreasing over time) overlaid with your "Cash Flow" effect (your checking account staying above the minimum floor). This visual confirmation provides the confidence that your plan is not just mathematically optimal, but practically executable.

Conclusion: a tracker that grows with you

A simple debt snowball tracker is a good tool for starting your journey, but a comprehensive financial model is often necessary for finishing it efficiently. As your financial life becomes more complex—with changing income, variable expenses, and strategic debt moves—static tools often break under the pressure.

Quadratic offers the flexibility to build a system that mirrors reality, providing robust personal finance templates to help you take control of your money.

Use Quadratic to Optimize Debt & Cash Flow

- Integrate debt payoff with real-time cash flow: Model precise income and expense timing to ensure debt payments don't risk overdrafts or liquidity stress.

- Maintain a minimum cash floor: Set a safety threshold for your checking account, preventing payments that would drop your balance below a safe level on any given day.

- Dynamically manage credit card float: Accurately track credit card expenses and statement cycles, reflecting true cash movement rather than static monthly totals.

- Automate amortization and promotional tracking: Instantly recalculate amortization schedules, interest savings, and flag critical promotional APR expiry dates.

- Run "what-if" scenarios for optimal strategy: Compare balance transfers or consolidation loans to see the immediate impact on your debt-free date and cash liquidity.

Ready to build a debt payoff plan that works with your real-world cash flow? Try Quadratic.