Purpose of the Real Estate ROI Calculator

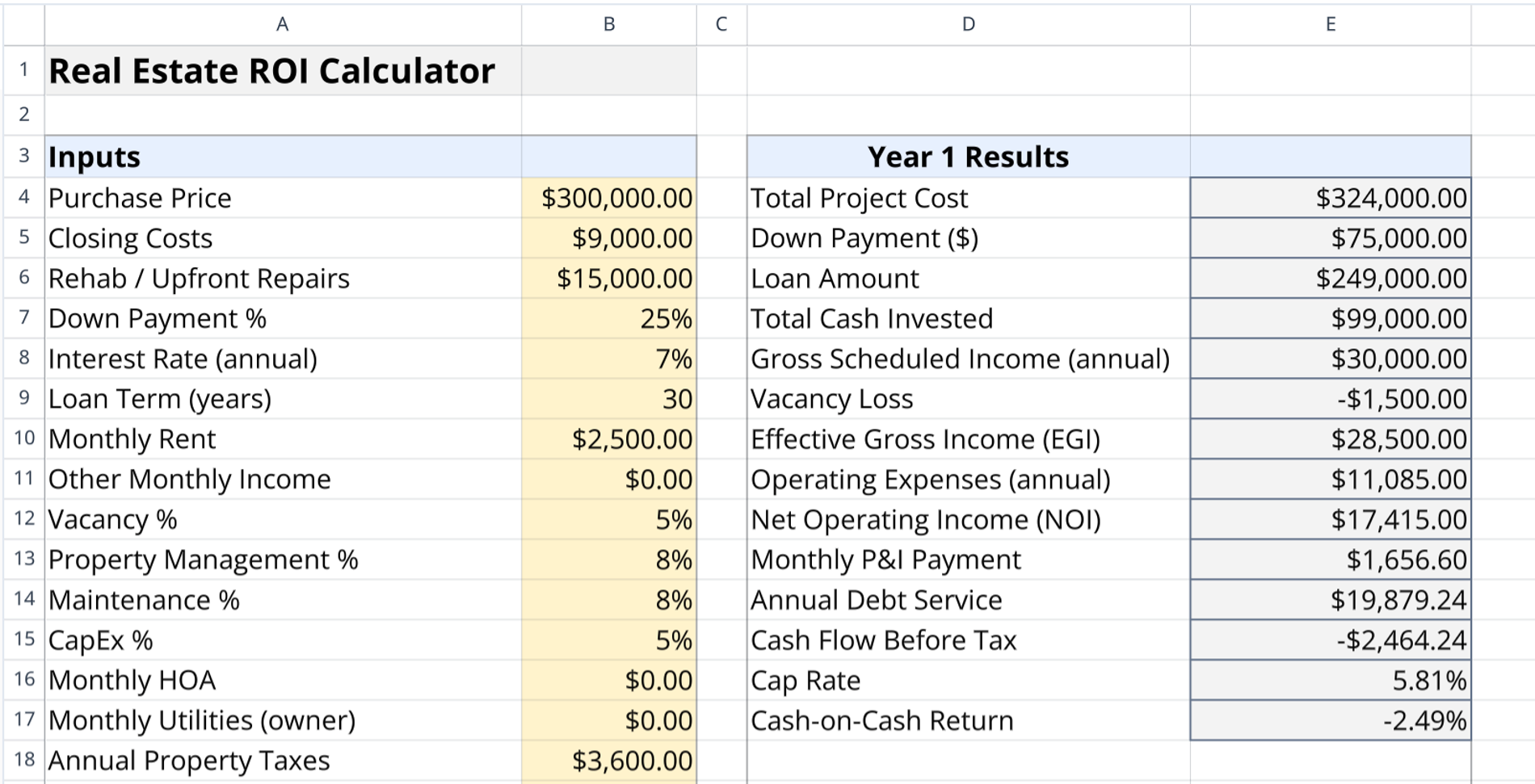

This template evaluates residential investment property returns using a streamlined, single-sheet model, much like a comprehensive real estate pro forma template. It functions as a dynamic two-column tool where users enter data on the left to generate financial metrics on the right.

- Calculates immediate cash requirements and long-term profit projections

- Updates metrics instantly based on user-defined financing and operating assumptions

- Eliminates the need for complex SQL queries or multi-sheet navigation

Input parameters

All user-modifiable fields are located in columns A and B of the spreadsheet. These parameters require manual entry of specific property and market data to drive all downstream calculations in the output section.

Acquisition and financing details

- Purchase price: The target buying price of the asset

- Closing costs: Estimated fees associated with the transaction

- Rehab expenses: Budgeted costs for immediate repairs or improvements

- Down payment: Percentage of purchase price paid upfront

- Loan terms: Interest rate and loan duration in years

- Reserves: Initial cash set aside for contingencies

Operating and projection assumptions

- Income variables: Monthly rent and expected vacancy rate

- Expense variables: Property tax rate, annual maintenance, insurance, and other costs

- Holding period: Intended duration of property ownership in years

- Growth rates: Annual percentage increases for appreciation, rent, and expenses

- Selling costs: Percentage of future sale price deducted for agent fees and closing

Understanding the output metrics

The calculated results are located in columns D and E of the spreadsheet. These cells update dynamically whenever input values in the first two columns are modified.

Year 1 financial results

- Total project cost for asset acquisition: Sum of purchase price, closing costs, and rehab expenses

- Total cash invested: Aggregates down payment, closing costs, and rehab

- Net operating income (NOI): Effective gross income minus total operating expenses

- Debt service: Monthly principal and interest calculated via standard amortization formulas

Long-term holding period analysis

- Future sale price: Purchase price compounded by the appreciation rate over the holding period

- Remaining loan balance: Outstanding debt calculated at the end of the holding term

- Net sale proceeds: Sale price minus selling costs and remaining mortgage balance

- Cumulative cash flow: Sum of annual cash flows adjusted for rent and expense growth

Return on investment metrics

- Total profit: Combines net sale proceeds with cumulative cash flow

- Total ROI: Expresses total profit as a percentage of initial cash invested

- Annualized ROI: Approximates the compound annual growth rate of the investment

How to calculate ROI in real estate using this tool

- Enter the property asking price, often informed by a comparative market analysis template, and estimated closing costs in the acquisition section.

- Input financing details including interest rate and down payment percentage

- Estimate monthly rental income, which can be tracked using a rent roll template, and recurring operating expenses.

- Set the expected holding period and market appreciation assumptions, often informed by a housing market analysis template.

- Review the calculated Total ROI and Annualized ROI in the bottom right section

Who this Real Estate ROI Calculator is for

- Real estate investors analyzing potential rental properties

- Property managers forecasting long-term asset performance

- Real estate agents presenting investment scenarios to clients

- Financial planners helping clients evaluate real estate portfolio additions using an investment tracking spreadsheet.

Use Quadratic to do Real Estate ROI Analysis

- Streamline investment property analysis on a single sheet.

- Instantly update financial metrics based on financing and operating assumptions.

- Calculate immediate cash requirements and long-term profit projections.

- Avoid complex SQL queries or cumbersome multi-sheet navigation.

- Evaluate total project cost, net operating income, and annualized ROI in one view.

Related templates

Real Estate Pro Forma Template

Quickly evaluate potential real estate investments. Track income and expenses, Determine IRR and analyze equity building of real estate.

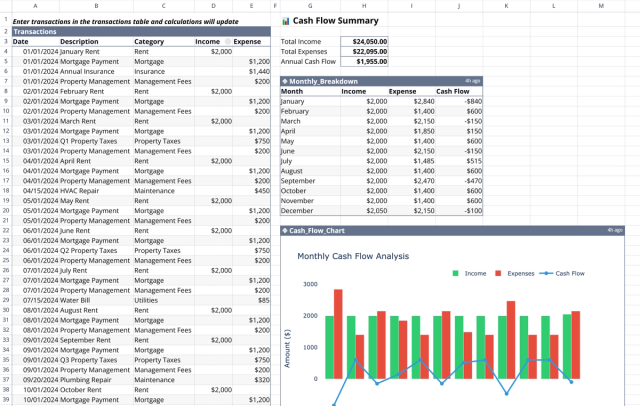

Cash Flow Statement Template: Rental Property Tracker

Track and visualize your rental property's monthly cash flow.

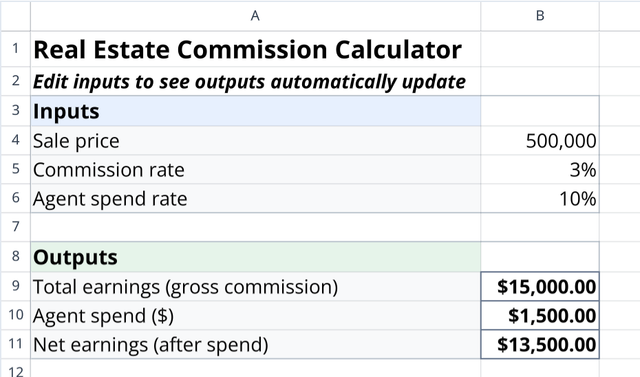

Real Estate Commission Calculator: Gross & Net Earnings

Calculate real estate commissions, agent spend, and net earnings.