The regulatory environment surrounding digital assets has shifted dramatically, with the Treasury and IRS releasing final regulations requiring brokers to report digital asset sales. With tax authorities increasing their scrutiny on cryptocurrency, the days of estimating gains or ignoring complex on-chain activity are effectively over. For investors and finance professionals, the challenge is no longer just about generating alpha; it is about proving it. While the blockchain is ostensibly transparent, the practical reality of tracking crypto transactions across fragmented wallets, centralized exchanges, and DeFi protocols is a massive data engineering nightmare.

Most taxpayers attempt to solve this with automated tax software. These tools work well for simple buy-and-hold portfolios, but they often fail when faced with the complexity of high-volume trading, staking, or cross-chain bridging. Users frequently encounter "missing cost basis" errors or inexplicable calculations that cannot be audited. To achieve true compliance and peace of mind, professionals are turning toward transparent, data-first workflows. Instead of relying on a "black box" that spits out unverifiable numbers, they are building workflows for tax reconciliation that allow them to see, clean, and verify every line of data.

The reality of visibility: can crypto transactions be tracked?

Before diving into the mechanics of tax reporting, it is essential to address the most common question in the space: can the government track these movements? The answer is a definitive yes, but with nuances that matter for your reporting, as outlined in the official IRS digital asset reporting guidelines.

Government agencies utilize sophisticated on-chain analysis and data from centralized exchanges (via KYC/AML on-ramps) to map wallet identities. Similarly, any individual can track crypto transactions using public block explorers like Etherscan or Solscan. Visibility of movement is rarely the issue.

The disconnect arises because tracking movement is not the same as tracking tax basis. A block explorer can tell you that 10 ETH moved from Wallet A to Wallet B. It cannot tell you that you bought that ETH three years ago for $200, or that the transfer was a non-taxable self-transfer rather than a sale. This data gap is where the taxpayer’s responsibility begins. You must bridge the gap between raw blockchain data and a compliant financial ledger, adhering to established cost basis principles.

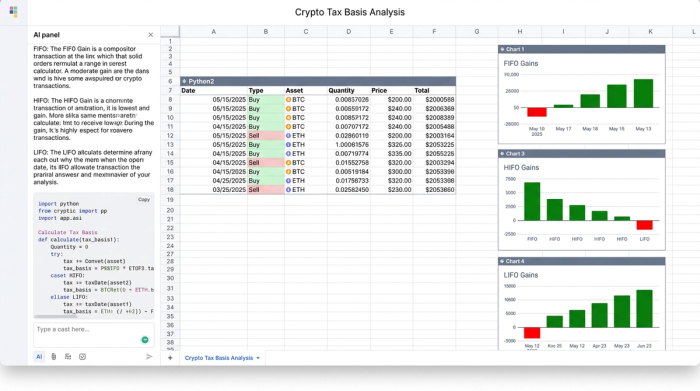

Strategies for tracking: FIFO vs. HIFO vs. LIFO

Once you acknowledge that you are responsible for the data, you must choose an accounting method to determine your capital gains or losses. The three most common strategies include:

- FIFO (First-In, First-Out): This assumes the first coin you bought is the first one you sold. This is the standard default for many tax jurisdictions but can result in higher tax bills if your earliest coins were purchased at very low prices.

- HIFO (Highest-In, First-Out): This matches your sales against the most expensive coins you purchased. This is often preferred for minimizing immediate tax liability, as it reduces the spread between the buy and sell price. You can learn more about the HIFO (Highest-In, First-Out) accounting method here.

- LIFO (Last-In, First-Out): This assumes the last coin added to your wallet is the first one sold.

Choosing a method is conceptually simple. The difficulty lies in execution. You cannot apply HIFO logic if your data is missing the purchase timestamp or the original price. If your transaction history has gaps—common when bridging tokens or using obscure DEXs—the mathematical logic breaks down. This is why the primary challenge of tracking crypto transactions is not accounting, but data normalization.

How to track crypto transactions (The "Troubleshooter" workflow)

For those dealing with messy data or "missing cost basis" errors, the solution is not to try another automated tool, but to build a transparent workflow for transaction reconciliation. By using a platform like Quadratic, which combines the familiarity of a spreadsheet with the power of Python and SQL, you can build a custom engine to clean and reconcile your history.

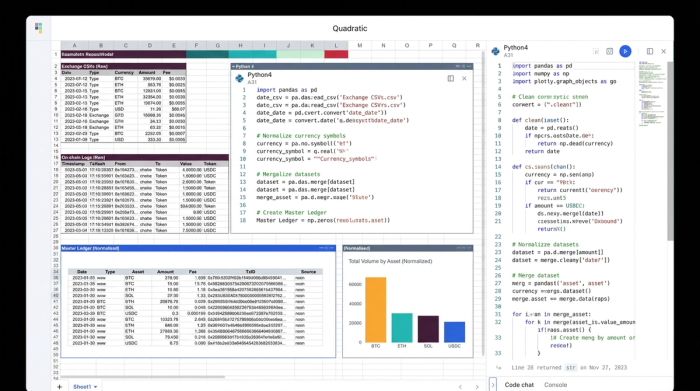

Step 1: Ingestion and normalization

The first step for crypto data exploration is aggregating your trade history. You likely have CSV exports from exchanges like Coinbase or Kraken, and perhaps raw transaction logs from on-chain wallets. The problem is that these sources rarely speak the same language. One file might use UTC timestamps, while another uses your local timezone. One might list Ethereum as "ETH," while a DeFi protocol lists it as "WETH" or "stETH."

In a standard spreadsheet, fixing this requires hours of manual copy-pasting and fragile formulas. In Quadratic, you can import these disparate files and use Python to normalize them programmatically. You can write a script to convert all timestamps to a single standard format and map all ticker symbols to a clean "Master Asset" list. This creates a unified "Master Ledger" where every transaction, regardless of its source, follows the same structure.

Step 2: Calculating cost basis

With a normalized dataset, you can now apply your accounting logic. Rather than hoping a software’s opaque algorithm is correct, you can define the logic yourself.

Using Python or SQL directly within the grid, you can sort your Master Ledger by date and asset. You can then script the logic to match "Sell" events against "Buy" events according to your chosen strategy (e.g., FIFO). This transparency allows you to verify that a specific sale in 2023 is indeed being matched against that specific purchase from 2021.

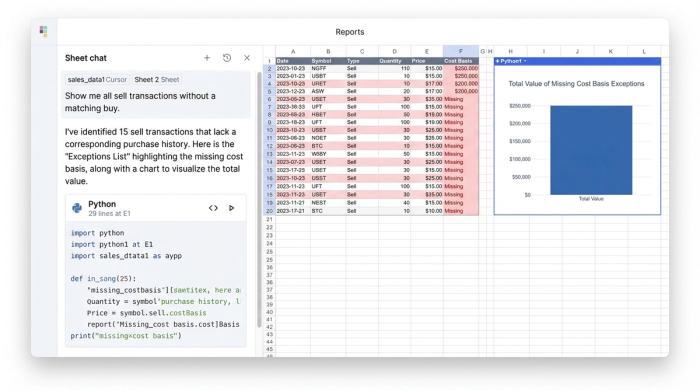

Step 3: Handling the "missing cost basis"

This is where the "Troubleshooter" workflow shines. In automated software, a missing purchase history usually results in a generic error message or a cost basis of zero, which artificially inflates your taxes.

In a data-centric environment, you can handle this proactively. You can run a SQL query to identify "unmatched sells"—transactions where the algorithm cannot find a corresponding buy. This generates a specific "Exceptions List." Instead of a red warning banner, you get a clean list of rows to investigate. You might discover that a specific bridge transfer was labeled as a "withdrawal" rather than a "transfer," breaking the chain of custody. Because you have direct access to the data, you can correct that specific row and rerun the calculation instantly.

Why the "best crypto transaction tracker" is one you can audit

The search for the best crypto transaction tracker often leads users to lists of SaaS products. However, for power users and those with complex on-chain activity, the best tool is one that offers auditability.

When you rely on a "black box" solution, you are trusting a third party to interpret your financial history. If they get it wrong, you are still liable for the tax return you sign. By building your workflow in a transparent environment like Quadratic, you eliminate the guesswork. You can see the raw data, the code that cleans it, and the formulas that calculate the tax.

This approach also offers superior flexibility. If you want to see how switching from FIFO to HIFO impacts your tax bill, you can simply adjust the logic in your code block and watch the results update immediately. You are not locked into a rigid system; you are building a tool that adapts to your specific data needs.

Final reporting and compliance

The ultimate goal of this process is a clean, defensible tax report. By the end of the workflow, your Master Ledger should yield a Capital Gains summary that aggregates your short-term and long-term proceeds. This data is structured and ready to be used for official Form 8949 instructions or to validate 1099-DA forms received from exchanges.

More importantly, you possess data lineage. In the event of an audit, you are not just showing a final number; you can demonstrate exactly how you arrived at that number. You can show the raw import, the normalization logic, and the specific lot-matching calculations.

Conclusion

Effective tracking is not just about watching price movements; it is about rigorous data engineering. As tax reporting requirements become more stringent, the ability to take control of your transaction history is invaluable.

Stop fighting with broken CSV imports and opaque error messages. By adopting a transparent, programmable approach to your data, you can turn a compliance nightmare into a manageable, auditable process.

Try Quadratic, the AI spreadsheet that does your work for you

Use Quadratic to track crypto transactions

- Consolidate and normalize fragmented data: Easily import crypto transaction data from multiple exchanges and wallets (CSV, raw logs) and use Python to standardize timestamps and asset names into a unified "Master Ledger."

- Precisely calculate cost basis: Apply custom FIFO, HIFO, or LIFO accounting logic using Python or SQL directly in the grid, ensuring accurate and verifiable capital gains calculations.

- Proactively resolve "missing cost basis" errors: Identify and address unmatched transactions with SQL queries, allowing you to manually correct data gaps and rerun calculations instantly, avoiding inflated tax liabilities.

- Ensure full auditability and transparency: See the raw data, the code cleaning it, and the formulas calculating your tax, providing complete data lineage for compliance and peace of mind.

- Adapt to complex scenarios: Build a flexible workflow that handles high-volume trading, staking, and cross-chain activity, easily adjusting accounting methods to optimize tax outcomes.

Ready to take control of your crypto tax reporting? Try Quadratic.