Modern finance teams are often swimming in data but starving for insights. You have gigabytes of transaction logs, yet answering a simple question like "How much did we spend on flights to London last quarter versus budget?" can take days of manual work without proper spreadsheet automation. The chaos stems from the fact that T&E data rarely lives in one place, presenting common financial data integration challenges as it is scattered across booking tools, credit card statements, and HR systems.

True travel and expense data analytics is not just about generating a generic report from your expense software; it is the strategic unification of these disconnected sources to uncover savings and enforce policy. You do not necessarily need a more expensive T&E platform to solve this. You need a better environment to analyze the data you already own. Quadratic offers an infinite canvas where code, SQL, and spreadsheets meet, positioning it among the best data science tools, allowing you to manually merge these silos and build the exact tracking mechanisms your business needs.

The "data silo" problem in T&E reporting

Most out-of-the-box dashboards fail because they are restricted to a single data stream. A report from your travel agency might show you booked flights, but it misses the out-of-pocket meals, ride-shares, and hotel incidentals that appear on expense reports. Conversely, a bank feed shows the total amount spent but lacks the context of what was purchased.

For the analyst, this results in a painful monthly ritual: exporting three or four different CSV files, opening them in Excel, and attempting to stitch them together using fragile VLOOKUPs, highlighting the need for a better alternative to Excel. This process is manual, prone to crashing when file sizes grow, and often breaks if a column name changes. To drive real strategy, finance teams need a tool that handles exploratory search and data merging fluidly, without hitting the row limits of traditional spreadsheets.

Step 1: Aggregating disparate data sources

The first step in gaining control over your spend is bringing your data into a single environment. In a standard spreadsheet, importing multiple large datasets can slow your workflow to a crawl. In Quadratic, you can pull in raw data from multiple sources side-by-side on an infinite canvas.

To build a comprehensive view, you should look to import:

- Travel Management Company (TMC) exports: This provides data on booked itineraries, including airlines, hotels, and car rentals.

- Corporate card feeds: This is your source of truth for what was actually charged to the company bank account.

- Expense submission reports: This dataset includes employee justifications, receipts, and out-of-pocket reimbursements.

By bringing these feeds into Quadratic, you create a centralized staging area. You can connect directly to databases or drag and drop CSVs, ensuring all your raw ingredients are visible in one workspace.

Merging data to reveal the truth

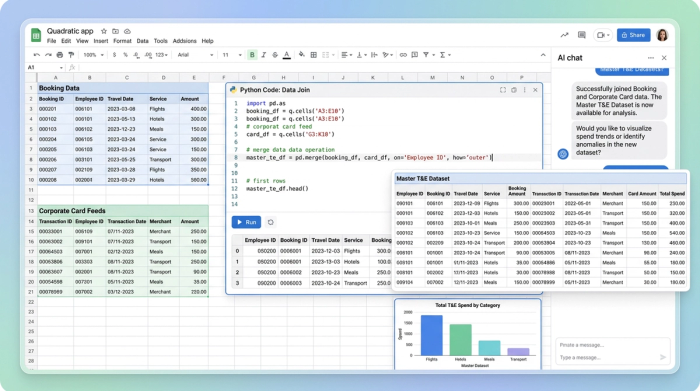

Once your data is on the canvas, the challenge is linking it together. This is where the limitations of standard spreadsheets usually halt progress. However, using Quadratic, you can utilize Python or SQL directly within the grid to join these datasets, employing techniques for merging financial datasets logically.

For example, you can write a SQL query to join your booking data with your corporate card feeds based on transaction dates, amounts, and employee IDs. This programmatic approach allows you to identify discrepancies instantly. You might find a flight that was booked (according to the TMC) but never charged, or more commonly, a charge on the corporate card that has no corresponding expense report submitted.

The outcome of this merge is a "Master T&E Dataset." This unified table serves as your single source of truth, eliminating duplicates and verifying that what was booked matches what was billed.

Step 2: Analyzing spend drivers by vendor and route

With a clean, merged dataset, you can move from data cleaning to strategic travel and expense data analytics. The goal here is to slice the data to understand where the money is going and negotiate better rates, often informed by corporate travel benchmarking.

Using the Python visualization libraries built into Quadratic, you can perform deep dives into specific spend drivers:

- Vendor analysis: Are you actually receiving the negotiated rates with your preferred hotel chain? By aggregating spend by vendor, you can see if employees are booking outside of your preferred partners.

- Route analysis: For companies with heavy travel, identifying the most expensive frequent routes is critical. You might discover that the New York to London route consumes 20% of your travel budget, signaling an opportunity to negotiate a specific contract for that lane.

You can visualize this data using Quadratic’s graphing capabilities, creating clear charts that show spend concentration by team, department, or geography, enabling robust financial data visualization that helps stakeholders visualize the impact of their travel habits.

Improving compliance and detecting outliers

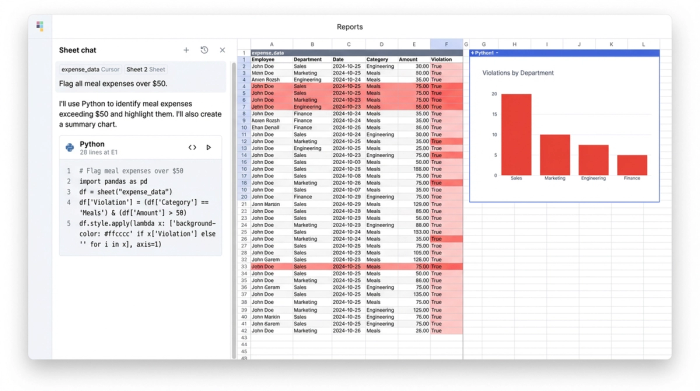

Beyond saving money on bookings, analytics plays a crucial role in audit and fraud prevention. Moving from descriptive analytics to advanced outlier detection methods in audit analytics allows you to catch non-compliant spend before it becomes a pattern.

In Quadratic, you can write simple Python scripts to flag transactions that violate expense policy compliance. For instance, you can programmatically highlight any meal over $50 per head or identify transactions made on weekends that are categorized as "office supplies."

This approach facilitates real-time travel expense tracking. Instead of waiting for a quarterly audit to find out an employee has been expensing personal items, connecting to live data sources allows you to flag these outliers immediately. This proactive stance protects the bottom line and reinforces a culture of accountability.

Step 3: Optimizing the reimbursement cycle

While compliance and savings are critical for the company, the employee experience matters too. A key metric to track is the reimbursement cycle time—the delta between when an expense is submitted and when the employee is paid back.

By analyzing the timestamps in your merged dataset, you can identify bottlenecks in the approval process. If the data shows that the engineering department takes three times longer to approve expenses than sales, you can investigate the cause. Faster reimbursements improve employee satisfaction and ensure that your team is not effectively lending money to the company interest-free, highlighting the broader benefits of optimized reimbursement programs.

From "what happened" to "what’s next"

The ultimate maturity in T&E analytics is moving from looking at past receipts to applying predictive modeling and analytics for forecasting future budgets. Because Quadratic is a programmable canvas, you are not stuck with the rigid, historical reports provided by SaaS vendors.

You can use your historical trend data to build forecast models. If booking lead times are shortening (indicating last-minute travel), you can project how that will impact the Q4 budget. This flexibility allows the finance team to build the exact report the CFO asks for, instantly, rather than saying "the system can't do that."

Conclusion

Effective travel and expense data analytics requires more than just a receipt scanner; it requires a data workspace that can handle complexity. By moving your workflow into Quadratic, you gain the ability to aggregate disparate sources, merge it with code-based precision, and visualize the results for actionable insights.

The workflow is clear: Aggregate your raw data, merge it to find the truth, analyze your spend drivers, and visualize the path to savings. It is time to stop fighting with rigid tools and manual VLOOKUPs. Try Quadratic, the AI spreadsheet that does your work for you, and start building a T&E command center that drives real business decisions.

Use Quadratic to do travel and expense data analytics

- Unify scattered T&E data from booking tools, credit card feeds, and expense reports on an infinite canvas.

- Merge disparate datasets with Python or SQL directly in the grid, eliminating manual VLOOKUPs and Excel crashes.

- Build a "Master T&E Dataset" to identify discrepancies and ensure a single source of truth for all spend.

- Analyze spend drivers by vendor and route using built-in visualization tools to negotiate better rates.

- Programmatically flag policy violations and detect outliers for proactive compliance and fraud prevention.

- Optimize reimbursement cycles by analyzing timestamps to identify and resolve approval bottlenecks.

- Develop custom reports and predictive models for accurate forecasting, moving beyond rigid historical data.

Stop fighting with manual processes and get clear insights into your T&E spend. Try Quadratic.