Table of contents

For many business owners and finance professionals, tax season isn’t stressful because of the math; it’s stressful because of the data preparation, particularly when managing an income and expense tracker. While transaction categorization is the backbone of clean books and audit-ready returns, the standard tools available, including many a receipt tracker, often force users into a frustrating dichotomy: tedious manual tagging or blind reliance on "black box" algorithms.

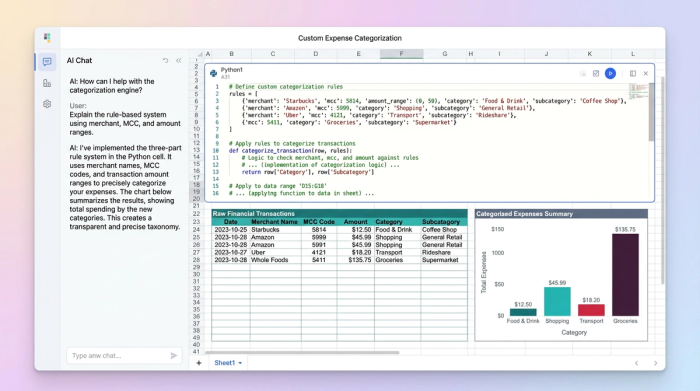

Most cloud accounting transaction categorization solutions offer a rigid workflow. You either click through endless rows one by one, or you trust an automated feed that frequently mislabels expenses. Quadratic offers a third path—a "middle-code" solution. By combining the familiarity of a spreadsheet with the power of Python, Quadratic allows you to build a custom, transparent engine. This gives you automated bookkeeping transaction categorization tools that you actually control, bridging the gap between slow manual entry and complex enterprise software.

Why "black box" automation fails business owners

If you have ever searched for how to categorize transactions in QuickBooks, you likely found yourself navigating a maze of drop-down menus and confirmation clicks. The alternative—relying entirely on the best AI accounting software for automated transaction categorization—presents a different risk. These platforms often use opaque machine learning models to guess your expenses.

The problem with this "black box" approach is the lack of nuance. An algorithm might see a charge for a restaurant and automatically tag it as "Business Meals," missing the context that it was actually a personal lunch that shouldn't be deducted. Or, it might categorize a software subscription as "Office Supplies" rather than "Dues and Subscriptions." When these errors compound over a fiscal year, they create a compliance nightmare that is difficult to untangle during an audit.

Quadratic solves this through transparent logic. Instead of hoping the software guesses correctly, you build the rules. This ensures that your transaction categorization is not only automated but also 100% explainable. If an auditor asks why a specific expense was categorized a certain way, you can point directly to the logic rule you created, ensuring total financial visibility.

Step 1: Defining your taxonomy (the rules layer)

Successful accounting software automated transaction categorization starts with a destination. Before importing data, you need a clear list of "buckets" that match your tax filing requirements. In Quadratic, you can set up a "Tax-Ready" reference table based on Schedule C or your corporate tax return fields, such as Advertising, Cost of Goods Sold (COGS), Rent, and Office Expenses.

Once your buckets are defined, you build the logic layer. In a recent use case, a business owner used Quadratic to build a three-pronged rule system that offered far more precision than standard keyword matching:

1. Merchant Name: This is the most direct rule. For example, if the merchant string contains "Starbucks," categorize as "Meals."

2. MCC Codes: For broader categorization, you can utilize Merchant Category Codes provided by payment processors to group similar vendors (like all gas stations) into a single "Travel" bucket, facilitating a comprehensive travel expense report.

3. Amount Ranges: This is where custom logic shines. You can create rules based on the transaction value. For instance, a purchase at "Amazon" under $50 might automatically go to "Office Supplies," while an Amazon purchase over $500 is flagged as an "Asset" for depreciation.

Step 2: Cleaning and parsing messy data

One of the biggest hurdles for automated bookkeeping transaction categorization software is the quality of the raw data. Bank feeds are notoriously messy, often exporting cryptic strings like "AMZN MKTPLACE WA 445" or "Check 50552." Standard accounting tools often fail to match these inconsistent strings to existing vendor lists.

Quadratic allows you to ingest this raw data and clean it programmatically before it ever hits your categorization rules. Using built-in Python or spreadsheet formulas, you can parse these messy strings to extract the core merchant name. By stripping away the random numbers and location codes, you standardize the data. This pre-processing step ensures that your rules trigger correctly, providing a level of accuracy that most accounting automation tools automatic transaction categorization features cannot match on their own.

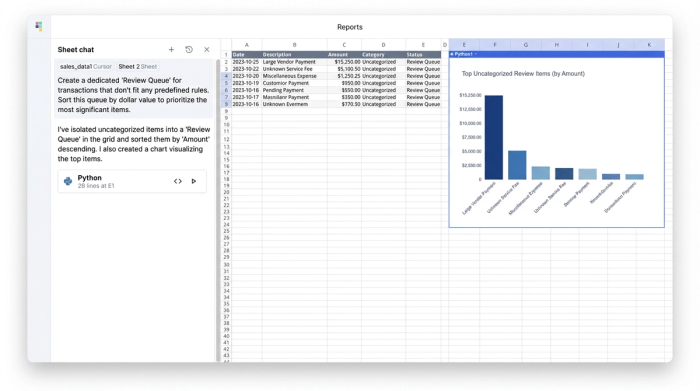

Step 3: The "uncategorized" review queue

Even the best accounting software transaction categorization workflows will encounter outliers. There will always be one-off transactions that don't fit your pre-defined rules. Most software handles this poorly, either hiding these transactions in a "Suspense" account or mixing them in with cleared items, making them easy to miss.

In Quadratic, you can build a dedicated workflow for these exceptions: the Review Queue. This is a dynamic list that populates automatically with any transaction that fails to match a rule.

The critical advantage here is prioritization. Instead of reviewing these items chronologically, you can sort the queue by dollar value. This logic shift is profound for a CFO or business owner. It ensures you review the mysterious $5,000 wire transfer immediately, rather than wading through dozens of $5 coffee charges first. This turns a chaotic list of uncategorized items into a prioritized, high-value management task, ensuring that significant deductions are never missed.

The result: Tax-ready financial visibility

The output of this engine is a live dashboard showing category totals by month, instantly updated as new data is imported. What used to take days of manual review at the end of the month now happens in seconds.

Because the transaction categorization process is governed by rules you defined, you have a clear audit trail for every dollar, which supports robust tax reconciliation. You aren't just getting speed; you are getting confidence. The system flags the high-value unknowns for your attention while automating the repetitive low-value volume, giving you a clean, tax-ready view of your financials at any moment.

Conclusion

Effective transaction categorization doesn't have to be a choice between manual drudgery and trusting an AI blind. By utilizing a tool like Quadratic, you can build a "glass box" engine—one where the automation is powerful, but the logic is entirely yours. This approach saves countless hours during tax season and provides the granular control necessary for confident financial reporting, serving as powerful financial reconciliation tools.

Try Quadratic, the AI spreadsheet that does your work for you.

Use Quadratic to automate transaction categorization for tax prep

- Build a custom, transparent categorization engine: Combine spreadsheet familiarity with Python to create rules you control, eliminating "black box" errors and ensuring audit-ready logic.

- Define precise categorization rules: Use merchant names, MCC codes, and transaction amount ranges to classify expenses accurately for tax purposes.

- Clean and standardize messy bank data: Programmatically parse cryptic transaction strings to ensure consistent and reliable categorization.

- Prioritize uncategorized transactions: Automatically populate a review queue, sorting by dollar value so you address high-impact outliers first.

- Achieve instant, audit-ready financial visibility: Access live dashboards with category totals, backed by a clear audit trail for every transaction.

Get started with a smarter way to manage your financials. Try Quadratic.