In the restaurant industry, notoriously thin profit margins make a detailed restaurant profit and loss template essential for financial health. While you can control food costs and labor schedules, cash handling remains one of the most vulnerable areas of operation. It is where profit leaks, such as those caused by inventory shrinkage, happen most frequently, whether due to simple human error, poor training, or internal theft.

For many shift leads and managers, the end-of-night transaction reconciliation process is a source of dread. It often involves a calculator, a pile of receipts, and a static daily cash log sheet. Doing manual math at 2:00 AM after a chaotic Friday night service is a recipe for mistakes. Worse, when you rely on a physical piece of paper, that data disappears into a filing cabinet, making it nearly impossible to spot patterns over time.

To stop shrinkage, restaurants need to move beyond the concept of a "printable" log. You need a living tool that calculates variances for you. This is where Quadratic changes the workflow. By combining the familiarity of a spreadsheet with the power of Python, Quadratic allows you to build a dynamic daily cash log that automates the math, enforces internal controls, and highlights variances instantly.

Why "internal controls" matter for your cash drawer

When you search for a daily cash log, you might just be looking for a way to count money. However, from an operational standpoint, the log is the backbone of your internal controls. It is not just about counting bills; it is about accountability.

For the shift lead running the floor, a robust daily cash drawer log is a shield. It protects honest employees from false accusations of theft by proving that the math aligns with the Point of Sale (POS) reports. When the process is loose or relies on scribbled notes, variances become a matter of opinion rather than fact.

Standardization is key. You need a Standard Operating Procedure (SOP) where the log is filled out exactly the same way every single night. When the input method is consistent, any deviation in the numbers stands out immediately.

Essential components of a daily cash log

To build a log that actually prevents loss, you need to track specific variables. A generic checklist isn't enough. Whether you are using a digital tool or a printable daily cash log template, your system must account for the following inputs to ensure the final reconciliation is accurate:

- Opening float/bank: The fixed amount of cash in the drawer at the start of the shift.

- Cash drops: Money moved from the register to the safe during the shift to prevent overflow, which requires a detailed deposit log.

- Tips payable/payouts: Cash paid out to servers at the end of the shift. This section often doubles as a daily petty cash log for small emergency purchases, like buying ice or lemons from a nearby store.

- Refunds: Documentation of any cash returned to guests, which must match POS records.

- Closing count: The physical cash remaining in the drawer at the end of the night.

How to build an automated cash log in Quadratic

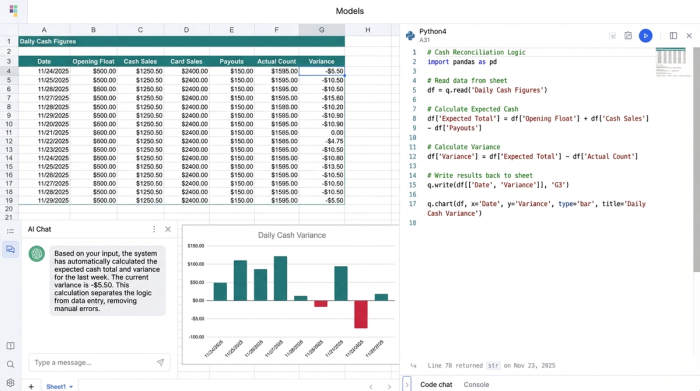

The problem with a standard daily cash log template Excel file is that it requires manual maintenance and often breaks, making it difficult to automate reconciliation processes effectively. In Quadratic, you can build a log that acts like an application. Here is how a typical restaurant manager utilizes Quadratic to automate this workflow.

Step 1: Setting the baseline

The workflow begins by establishing the "Float" or starting bank. In Quadratic, you can set this as a constant variable. Unlike a paper sheet where you have to write "$200.00" every night, the system remembers the baseline. The shift lead simply confirms the drawer starts at the correct amount.

Step 2: Tracking the shift

Throughout the shift, cash moves in and out. Managers often perform "safe drops" when the drawer gets too heavy. In a manual system, the manager has to add these drops up on a calculator.

In Quadratic, the shift lead enters each drop into a dedicated column. Using Python or simple formulas, the sheet automatically sums these entries in real-time. The same applies to tip-outs. If a server is owed $45.00 in cash tips, the manager logs it in the payout section. The tool aggregates these numbers instantly, removing the risk of addition errors.

Step 3: The reconciliation

This is the most critical step. At the end of the night, the manager counts the physical cash and enters the total into the "Closing Count" cell.

Quadratic then runs the reconciliation logic automatically. It takes the Opening Float, adds the Cash Sales (from the POS report), subtracts the Tips/Payouts, and subtracts the Cash Drops. It compares this theoretical total against the actual Closing Count.

The result is the "Variance." You no longer need to wonder if you missed a button on the calculator. The system tells you exactly how much the drawer is over or short.

Step 4: Visualization

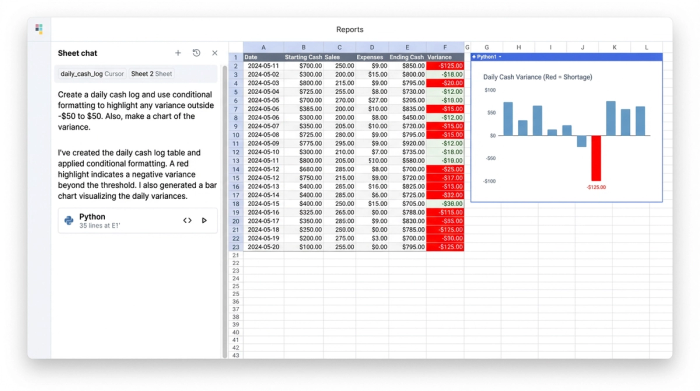

On a printable daily cash log, a variance of -$10.00 looks just like a variance of -$0.10. It is just ink on paper. In Quadratic, you can apply conditional formatting that acts as an alarm system.

You can program the sheet to highlight the variance cell in red if the discrepancy exceeds a specific threshold, such as +/- $5.00. This immediate visual cue prompts the manager to recount the drawer or investigate a missing receipt using a receipt tracker before they close the shift, fixing errors while the information is still fresh.

Better than Excel: why Python makes this template safer

You might be used to searching for a daily cash log template Excel file, downloading it, and hoping nobody breaks the formulas, a common risk with an Excel template for small business bookkeeping. The reality of Excel in a fast-paced restaurant environment is that formulas get overwritten constantly. A tired manager might accidentally type the closing count into the cell where the sum formula belongs, breaking the sheet for everyone who uses it afterward.

Quadratic offers a distinct advantage here because it supports Python. You can write the logic that calculates the variance in Python code, which sits separate from the grid where users enter data. This means the shift lead can type in their numbers freely without the risk of deleting the underlying math. It makes the template durable and "break-proof," ensuring that your financial data remains accurate shift after shift.

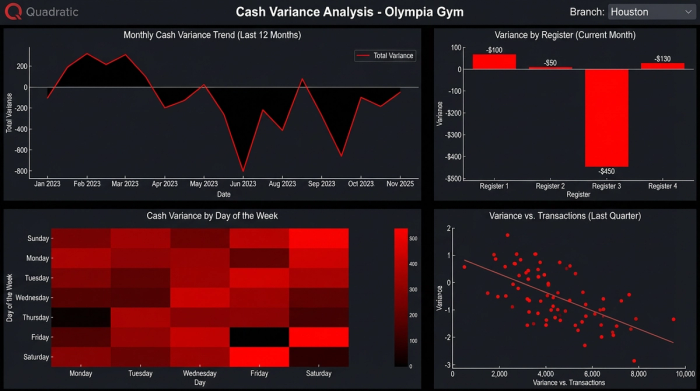

Analyzing the data: spotting trends by cashier or register

The true value of a digital log appears after a few weeks of data collection. A printable daily cash log ends up in a box; a Quadratic log builds a database, offering numerous benefits of automated reconciliation.

Because the data is stored digitally, you can easily analyze trends. You might notice that "Register 2" is consistently short on Friday nights. Is this a theft issue, or is the drawer spring broken, causing bills to slip behind the tray? Alternatively, you might see that a specific shift lead always has perfect drawers, while another consistently has small variances.

This data allows owners to make operational decisions based on facts rather than hunches, providing valuable insights for month end reconciliation and overall financial reporting. You can identify who needs more training on cash handling and who deserves recognition for accuracy.

Conclusion

Effective cash management is about visibility and consistency. When you move from a manual daily cash log sheet to an automated solution, you remove the guesswork from your finances. You empower your shift leads with tools that reduce stress and protect them from errors, and you give yourself the data needed to spot trends and prevent shrinkage. By integrating your log into a modern tool like Quadratic, you turn a nightly chore into a strategic asset for your restaurant.

Use Quadratic to manage your daily cash log

- Automate reconciliation: Eliminate manual errors and late-night calculations by instantly computing cash variances.

- Enforce internal controls: Standardize your cash handling process, ensuring consistent data entry and accountability for every shift.

- Prevent formula breakage: Use Python-backed logic to protect your cash log's calculations, making it robust and error-resistant.

- Spot variances instantly: Apply conditional formatting to highlight discrepancies in real-time, prompting immediate investigation.

- Identify cash trends: Build a digital database to analyze patterns by register or shift lead, helping pinpoint sources of shrinkage or training needs.

Modernize your cash management today. Try Quadratic.